unlevered free cash flow margin

The formula to calculate the unlevered free cash flow for a company is the following. Another reason for its prominence is that most multiple-based valuation techniques like comparable analysis use enterprise value EV.

:max_bytes(150000):strip_icc()/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

This metric is most useful when used as part of the discounted cash flow DCF valuation method where its benefits shine the most.

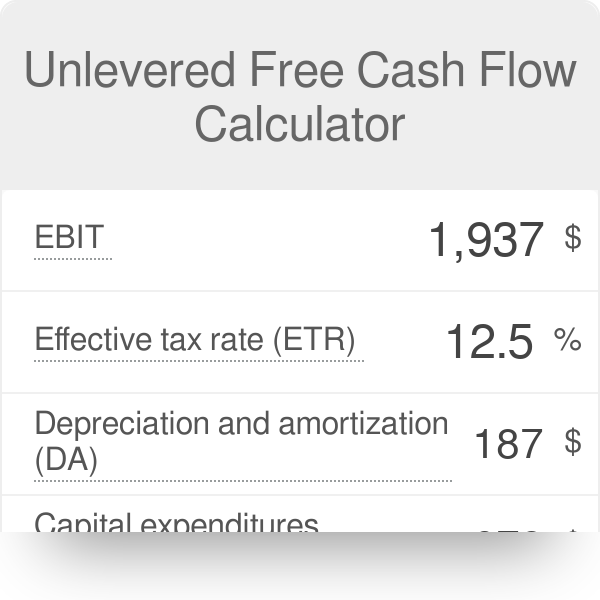

. Unlevered free cash flow UFCF is the cash generated by a company before accounting for financing costs. Then after adding this information to our unlevered free cash flow calculator we get. This represents the companys earnings from core business after taxes ignoring capital structure.

Levered free cash flow is the estimate of a companys. Unlevered free cash flow is used in DCF valuations or debt capacity analysis in highly leveraged transactions to establish the total cash generated by a business for both debt and equity holders. The formula to calculate unlevered free cash flow UFCF is as follows.

Unlevered Free Cash Flow Margin Unlevered Free Cash Flow Total Revenue 241 27078 B 1123 B. Unlevered free cash flow is generated by the enterprise so its present value like an EBITDA multiple will give you the Enterprise value. View HF Sinclair Corporations Unlevered Free Cash Flow Margin trends charts and more.

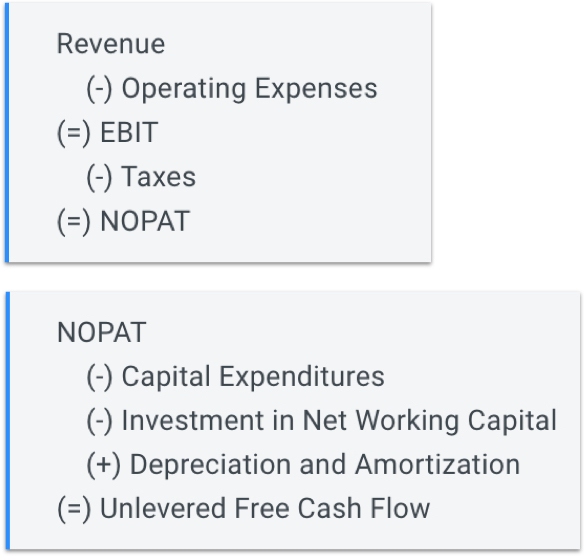

How to calculate unlevered free cash flow. Unlevered Free Cash Flow EBITDA CAPEX Working Capital Taxes. A business or asset that generates more cash than it invests provides a positive FCF that may be used to pay interest or retire debt service debt holders or to pay dividends or buy.

Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. It showcases enterprise value to debtholders with a stake in the companys financial wellbeing. Putting Together the Full Projections.

If all debt-related items were removed from our model then the unlevered and levered FCF yields would both come out to 115. The major difference between levered free cash flow and unlevered free cash flow is that while levered free cash flow takes financial obligations that a compost has into account UFCF gives no consideration to financial obligation. How to Calculate Unlevered Free Cash Flow.

Unlevered means that the free cash flow is free of leverage or debt and accurately depicts the amount of cash available to pay all stakeholders including both debt and equity holders. UFCF 4532 MUSD 1 - 174 1098 MUSD - 1128 MUSD - 703 MUSD. HF Sinclairs latest twelve months unlevered free cash flow margin is -48.

Investors perceive businesses with positive LFCF as financially healthy. The Difference Between Levered and Unlevered Free Cash Flow. Nvidia recorded an unlevered free cash flow of 372014 million USD during the 2021 fiscal year.

How Do You Calculate Unlevered Free Cash Flow. Unlevered Free Cash Flow Operating Income 1 Tax Rate Depreciation Amortization - Deferred Income Taxes - Change in Working Capital Capital Expenditures Why do we ignore the Net Interest Expense Other Income Expense Preferred Dividends most non-cash adjustments on the Cash Flow Statement most of Cash Flow from Investing and all of Cash. UFCF 372014 MUSD.

The look thru rule gave qualifying US. Unlevered free cash flow is usually only visible to financial managers and investors rather than to the average consumer. Levered free cash flow is the amount of cash that a company has remaining after accounting for payments to settle financial obligations short and long term including principal repayments.

Unlevered Free Cash Flow Formula. The formula that is used in order to calculate unlevered cash flow does not take into account debt or any payments that have to be made in order to settle the debts. EBIT Operating income income statement t tax rate computed by dividing income taxes by EBIT.

FCFF EBIT 1-t Depreciation Capital Expenditure Change in non-cash Working Capital. Free cash flow is the amount of money a company. Means total Unlevered Free Cash Flow for the current fiscal year minus the Board-approved pro forma Unlevered Free Cash Flow for Target for the current fiscal year total Revenue for the current fiscal year minus the Board-approved pro forma Revenue for Target for the current fiscal year minus one 1.

It is also referred to as levered cash flow and abbreviated as LFCF. Unlevered free cash flow UFCF is a companys cash flow before taking interest payments into account. Unlevered free cash flow can be reported in a companys.

And we know that NOPAT EBIT 1 Tax Rate. View nulls Unlevered Free Cash Flow Margin trends charts and more. Internal Revenue Code that lowered taxes for many US.

Levered free cash flow assumes the business has debts and uses borrowed capital. The formula to calculate unlevered free cash flow margin and an example calculation for Meta Platformss trailing twelve months is outlined below. UFCF EBITDA - CAPEX - Working Capital - Taxes.

To fully understand and successfully execute the unlevered free cash flow formula its crucial that you have a good grasp of the following definitions. The formula for UFCF is. Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx.

Unlevered Free Cash Flow - UFCF. Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes. Get the tools used by smart 2 investors.

These financial obligations signify the difference between unlevered free cash flow and levered free cash flow. Discounted Cash Flow DCF Overview Weighted-Average Cost of Capital. The levered FCF yield comes out to 51 which is roughly 41 less than the unlevered FCF yield of 92 due to the debt obligations of the company.

Define Unlevered Free Cash Flow Margin. Unlevered free cash flow earnings before interest tax depreciation and amortization - capital expenditures - working capital - taxes. A complex provision defined in section 954c6 of the US.

Therefore youll find that unlevered free cash flow is higher than levered free cash flow.

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Cash Flow Formula How To Calculate Cash Flow With Examples

Fcf Yield Unlevered Vs Levered Formula And Calculator

What Is Levered Free Cash Flow Definition Meaning Example

Unlevered Free Cash Flow Calculator Ufcf

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula

Discounted Cash Flow Analysis Street Of Walls

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets

Fcf Yield Unlevered Vs Levered Formula And Calculator

Understanding Levered Vs Unlevered Free Cash Flow

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Fcf Formula Formula For Free Cash Flow Examples And Guide

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial